Gifts That Keep Giving

Your tax-deductible donation can change lives and enhance community resources.

Well-planned gifts can help achieve financial, charitable and personal goals. You can choose where your donation goes:

- scholarships

- educational programs

- equipment purchases

- campus enhancements

- special projects

Donor recognitions, memorials and honorariums are an option with every gift.

Ways to Give

- Donate

Either a one-time gift or an on-going pledge can impact students' lives. This gift can be made throughout the year and may be directed at a specific scholarship fund or program.

Establishing a scholarship allows you to support an individual student who shares your passion. Foundation staff can walk you through the process which can allow you to establish a scholarship for as little as $1,000 a year.

Annual scholarships

Annual Scholarships are awarded each year the donor funds the scholarship. The minimum amount required for an annual scholarship is $1,000 with a three year commitment.

Endowed scholarships

An endowed scholarship lasts in perpetuity and represents an award based on at least a five percent interest rate of the principal (amount invested). The minimum amount required for an endowed scholarship is $24,000. This amount may be pledged over five years. The endowment will not be activated until the minimum amount is attained. If the minimum is not reached within five years, donors have the option to extend the pledge period or offer individual scholarship awards.

The principal will be invested according to the investment policy adopted by the Foundation and is intended to maximize the earnings on the principal consistent with a prudent level of risk. Copies of the investment policy and performance of the individual endowments are located in the Foundation office.

General scholarship fund

In addition to naming opportunities, donations may also be made to the general scholarship fund. Scholarships awarded from the general scholarship fund cover in-district tuition. The number of awards varies each year depending on the amount of funds that are available.

Contact us for further information on establishing a scholarship at HCC.

This option allows businesses to support various events and receive special promotional recognition. Sponsorships are limited and are reserved quickly.

Include the HCC Foundation in Your Estate or Planned Gifts

From including the Foundation in your will to insurance policies and securities, there are several ways to create a lasting legacy supporting local students. You will be recognized as a member of our Legacy society.

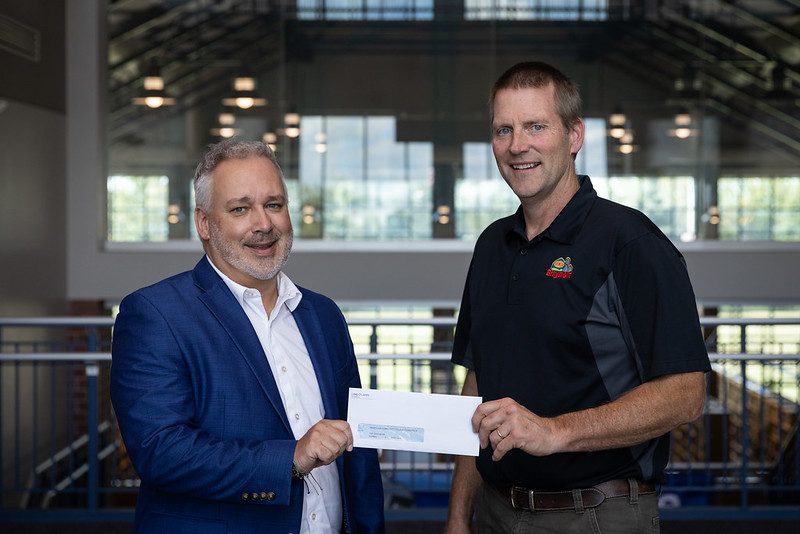

Raymond and Beulah Thompson Legacy Society

(Pictured: Raymond and Beulah Thompson)

You have the power to make a lasting impact on Heartland Community College students through a planned gift. The Raymond and Beulah Thompson Legacy Society honors and recognizes individuals who have chosen to make an impact on HCC through charitable gift plans.

By becoming a member of the society, you are ensuring HCC’s continued excellence in the future. Your planned gift will benefit the College's students, faculty and programs for many generations to come.

Ways to Give

As an HCC alumni, retiree, employee or friend you can do more for the College than you may have ever thought possible by considering a planned gift. A planned gift can take many forms:

Bequests

A bequest is a gift of any form or amount made outright in an individual’s will. Charitable bequests to the HCC Foundation can be included when executing a new will or added to an existing will through a codicil and are fully deductible for federal estate tax.

You may leave an unrestricted or restricted bequest of cash, property, or a portion or the entire residue of your estate. An unrestricted gift is the most valuable to the Foundation and is allocated where the need is the greatest, however you may establish your own endowment or contribute to an existing fund. View sample language (PDF).

Life insurance

Gifts of life insurance allow a donor to provide for beneficiaries, achieve substantial tax savings and make a larger gift than might otherwise have been possible. There are a number of ways to give a gift of life insurance. A policy can be contributed to the HCC Foundation or the Foundation can be named as a beneficiary or successor beneficiary of the policy.

Real estate

Gifts of appreciated real estate, such as a home, vacation property or undeveloped land, may allow a donor to avoid significant tax liability. There are various ways property may be donated.

Retirement plan assets

One frequently overlooked way to make a charitable contribution is by using qualified retirement assets. By naming the HCC Foundation as a beneficiary of your retirement account, you maintain lifetime control of these assets which pass to the Foundation upon your death. Your estate may be able to avoid certain income and estate taxes.

Funds from the employee campaign benefit the Foundation's general scholarship fund or can be designated to a specific scholarship or program of the your choice.